The cryptocurrency industry has experienced a tremendous amount of growth in the past years. That’s why it’s sometimes hard to keep track of what’s exactly going on. A summary report of Q1 2021 in collaboration with crypto data provider CoinGecko.

CoinGecko, one of world’s leading cryptocurrency aggregators, has released its Q1 2021 Report. In their analysis of the market, they observed that Decentralized Finance (DeFi) on Binance Smart Chain (BSC) has grown significantly in the first quarter of 2021. Bitcoin has broken new all-time highs and non fungible tokens (NFTs) have gathered a lot of attention.

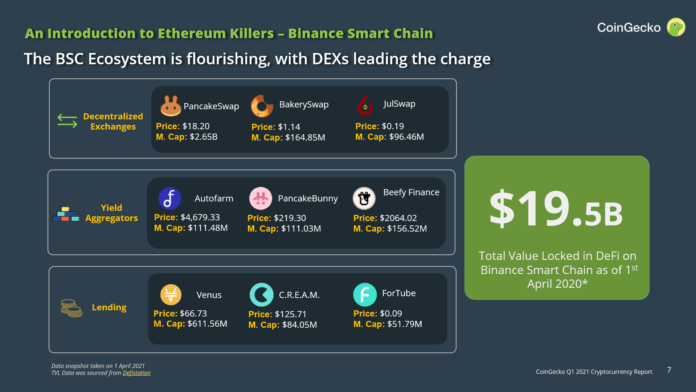

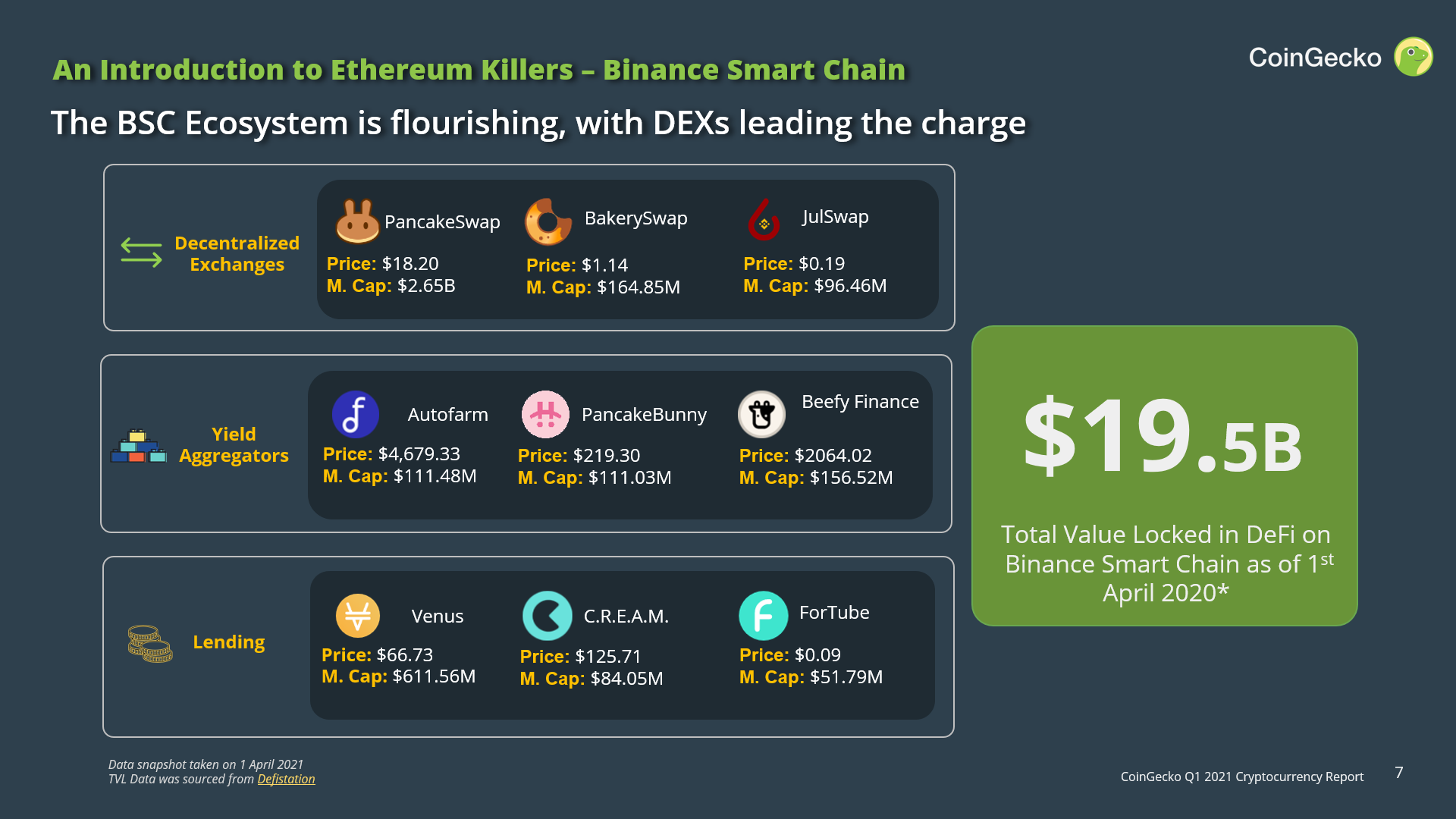

Binance Smart Chain’s TVL Grew to $20 Billion

On the 1st of April, it had close to $20 billion in Total Value Locked (TVL) which is a three-fold increase from the previous quarter. While Decentralized Exchanges (DEXs) continue to be the major pillars in the space, PancakeSwap in particular is leading the race on BSC with a total market cap of $2.5 billion.

Source: Coingecko

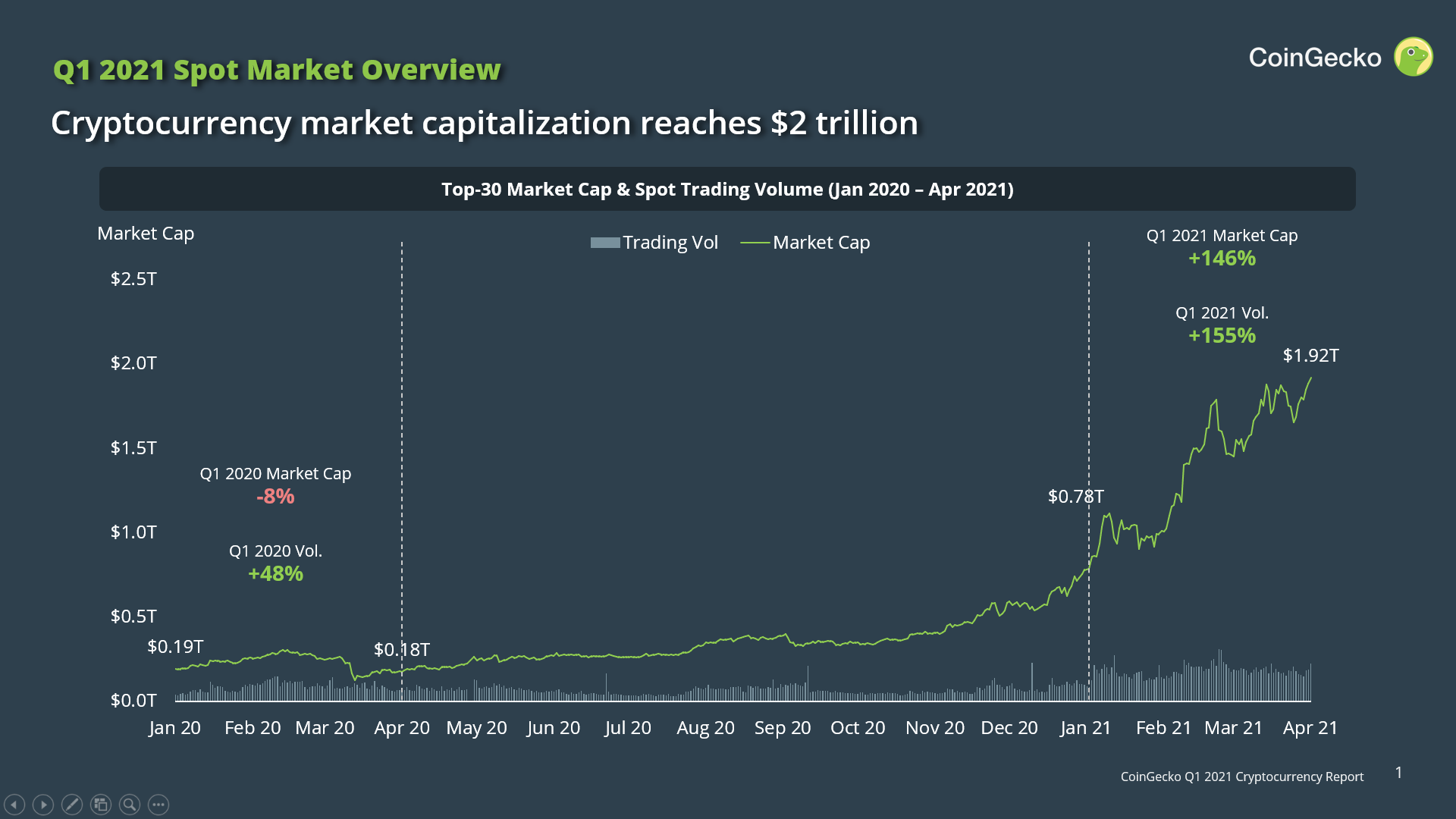

Cryptocurrency Market Capitalization broke pass $2 trillion

At the end of Q1 2021, the total crypto market cap successfully hit $1.9 trillion which is a significant 146% growth from $780 billion in the previous quarter. However, 57% of the market cap belongs to Bitcoin which has seen significant growth and support this quarter.

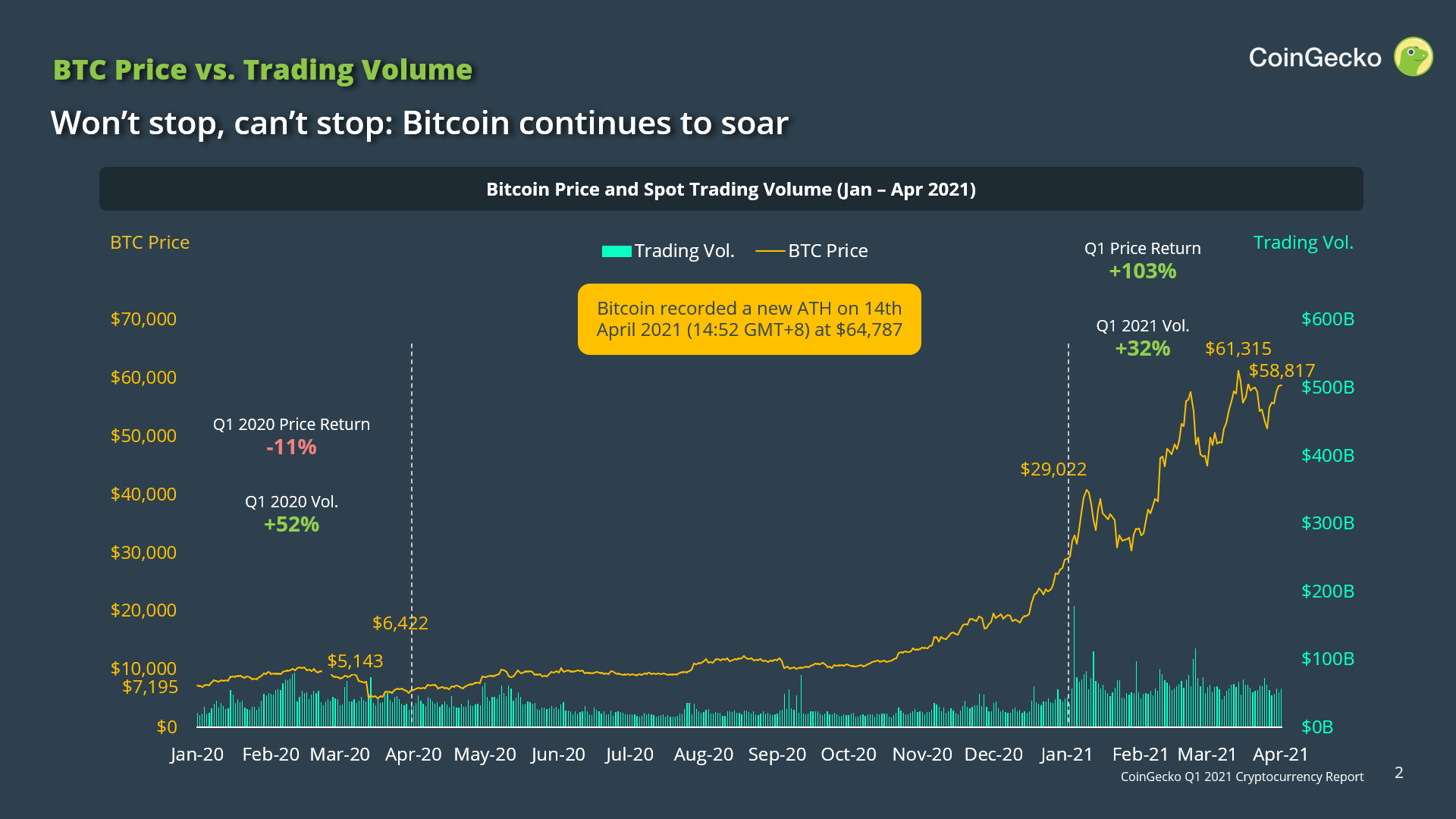

Bitcoin breaks new all time highs

In this quarter alone, Bitcoin recorded multiple All Time Highs and also hit a new ATH of $64,787 on the 14th of April. It has grown 1,097% in comparison to a year ago on 13th March when Bitcoin crashed 40% intraday to $5,413. The coin ended Q1 2021 at $58,817 with the bullish growth largely fueled by institutions which include:

- Tesla holding Bitcoin as an investment asset and now accepts it as a form of payment

- Visa enabling USDC as a settlement on Ethereum

- Grayscale’s plan to offer Crypto ETF

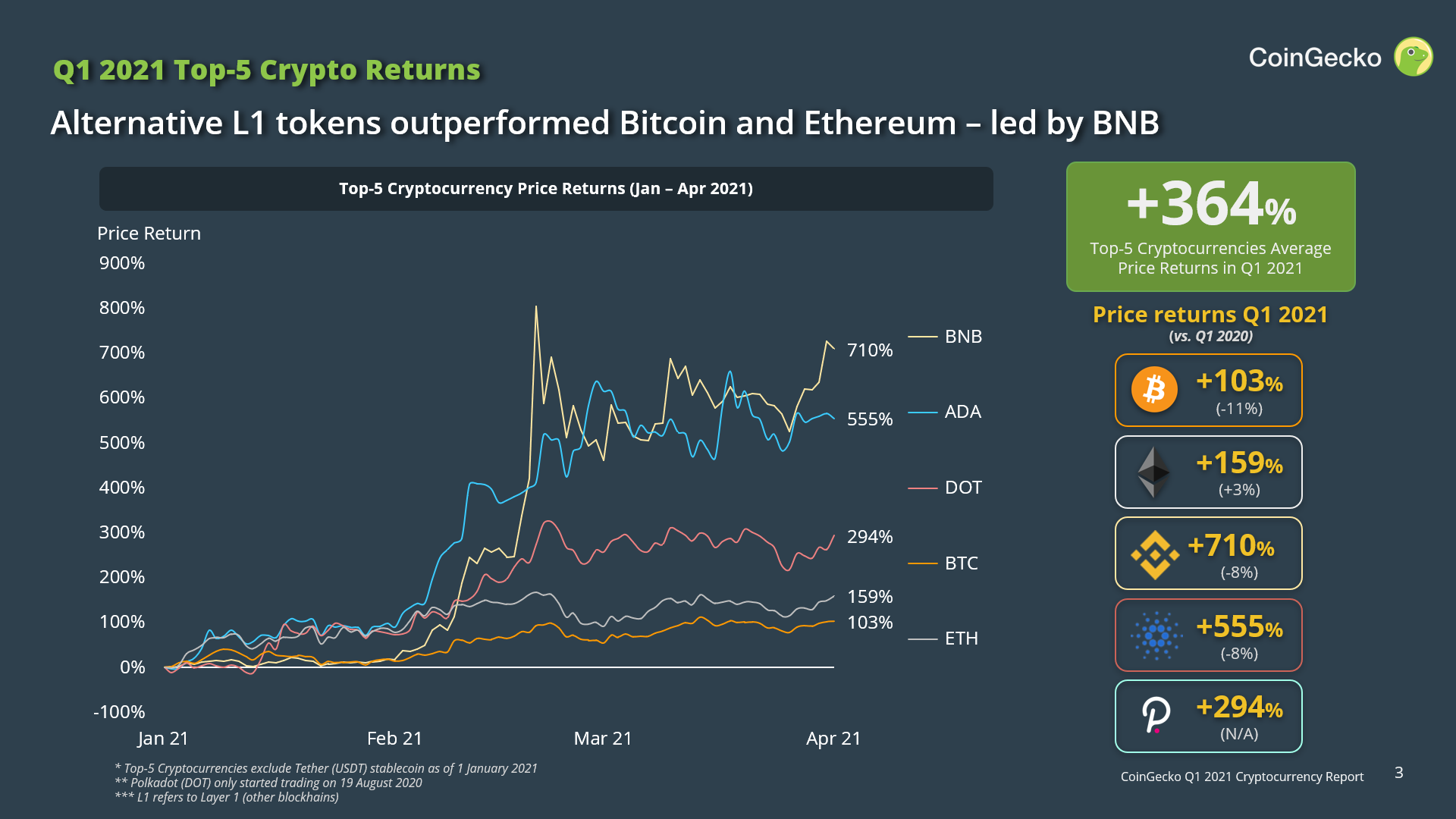

BNB and L1 tokens outperformed Bitcoin & Ethereum

The first quarter of the year also saw Bitcoin and Ethereum underperforming in comparison to their competing networks. Binance Coin (BNB) specifically had the best performance with a 710% gain. This was closely followed by Cardano (ADA) and Polkadot (DOT) with 555% and 295% growth respectively.

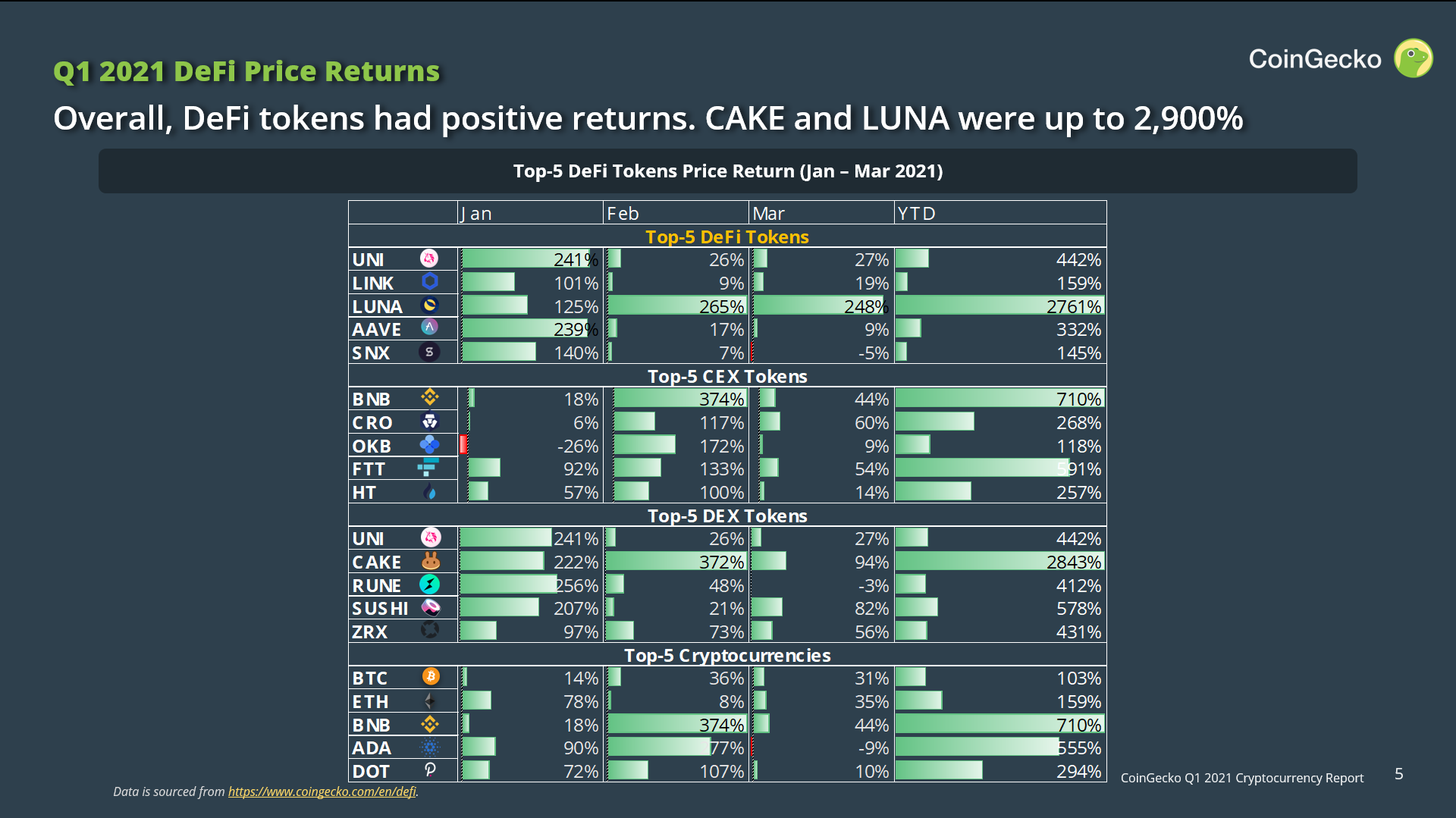

CAKE and LUNA rose up to 2’900% return

From the top 5 DeFi tokens, Terra (LUNA) experienced the highest growth with a 2’761% increase over the first three months of the year. Interestingly, the Centralized Exchange (CEX) and Decentralized Exchange (DEX) categories appear to be showing signs of fortification ahead of the Coinbase public listing in April 2021. Meanwhile, Uniswap successfully claimed the top spot for market cap in both categories. However, PancakeSwap (CAKE) has surged more than 28x in value since the beginning of the year.

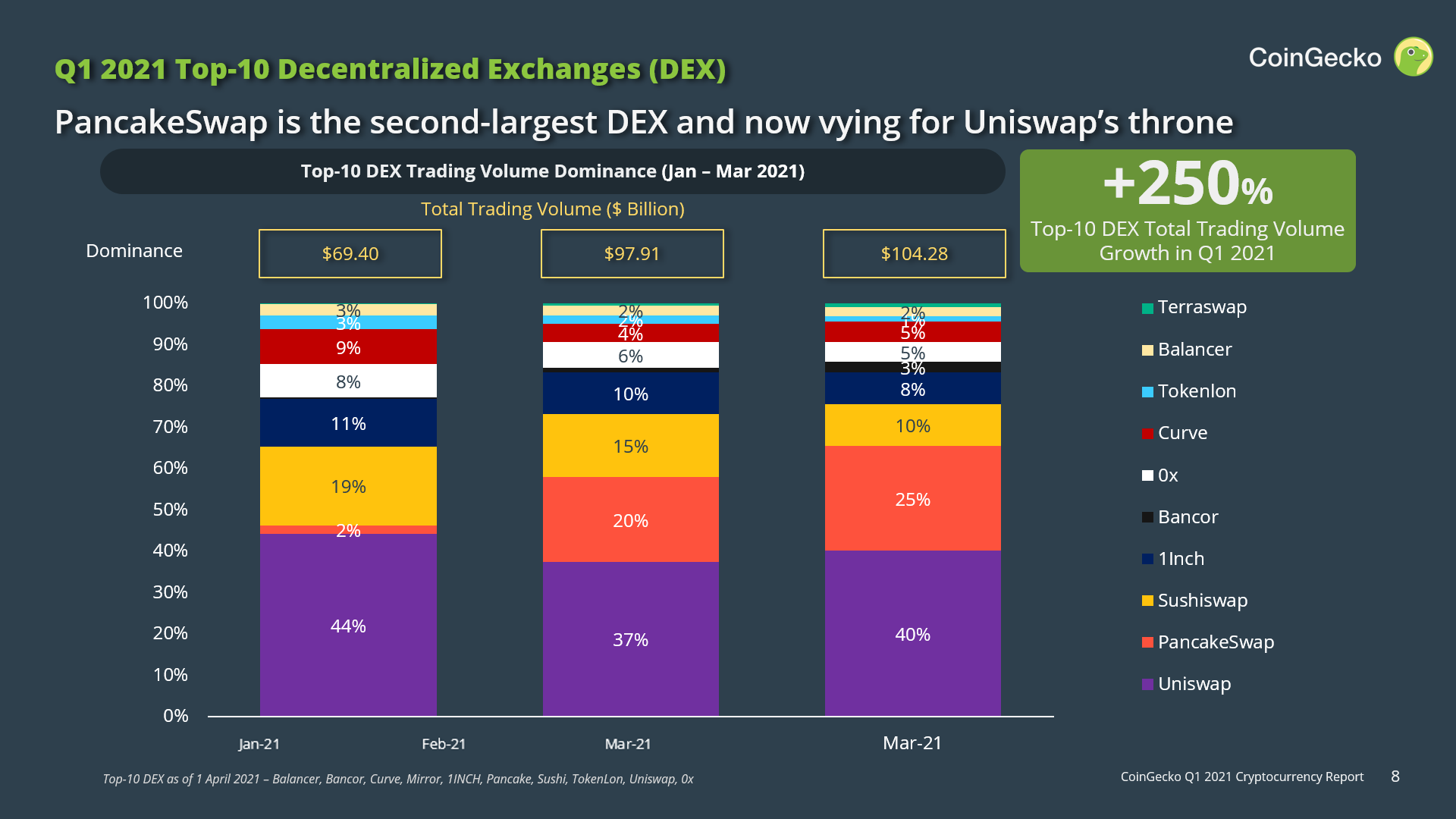

PancakeSwap became the second-largest DEX

DEXs also saw a net increase of 250% (+$75 billion) in spot trading volume, with the main drivers, PancakeSwap and Uniswap, accounting for 70% (+$52 billion) of the volume increase. Although the DEX category grew, Tokenlon saw its volume decline marginally by $620 million from December 2020 to March 2021.

In regards to dominance of the space, only PancakeSwap (25%), Bancor (3%), and Terraswap (1%) effectively increased their market share. In fact, Uniswap is now losing its foothold as the “King of DEXs” to PancakeSwap which coincides with the rise of BSC as the more cost-friendly alternative to Ethereum.

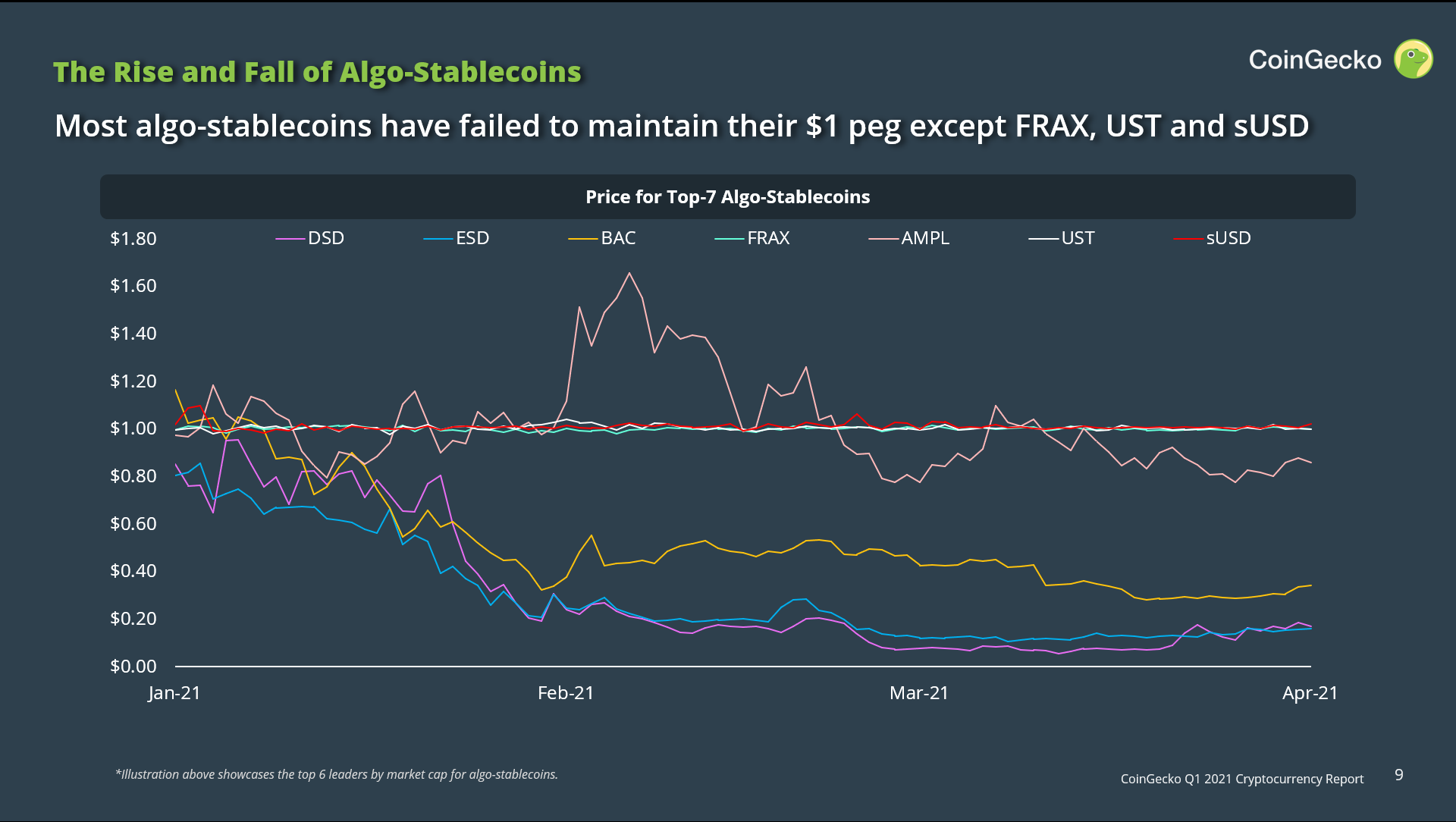

UST, FRAX, and sUSD as successful algo-stablecoins

The top-7 algo-stablecoins’ total market capitalization account for $2.23 billion with TerraUSD (UST) commanding the lion’s share of the market at $1.6 billion (72.8%). Following behind is Ampleforth (AMPL) with a market cap of $250 million (11.2%) while sUSD (SUSD) amounts to $224 million (10.05). Meanwhile, newcomer Frax (FRAX) has a relatively modest market cap of $113 million (5.1%).

Despite its establishment in 2019, AMPL has yet to stabilize its price at $1 through its rebase-type model. Nonetheless, it is clearly outperforming its Seigniorage peers outside of FRAX, UST, and sUSD. Impressively, throughout the first quarter of the year, FRAX and UST have adequately maintained their peg as their price has an average deviation of less than 0.5% ($1.001 vs $1.005 respectively). Meanwhile, sUSD deviated 1% on average.

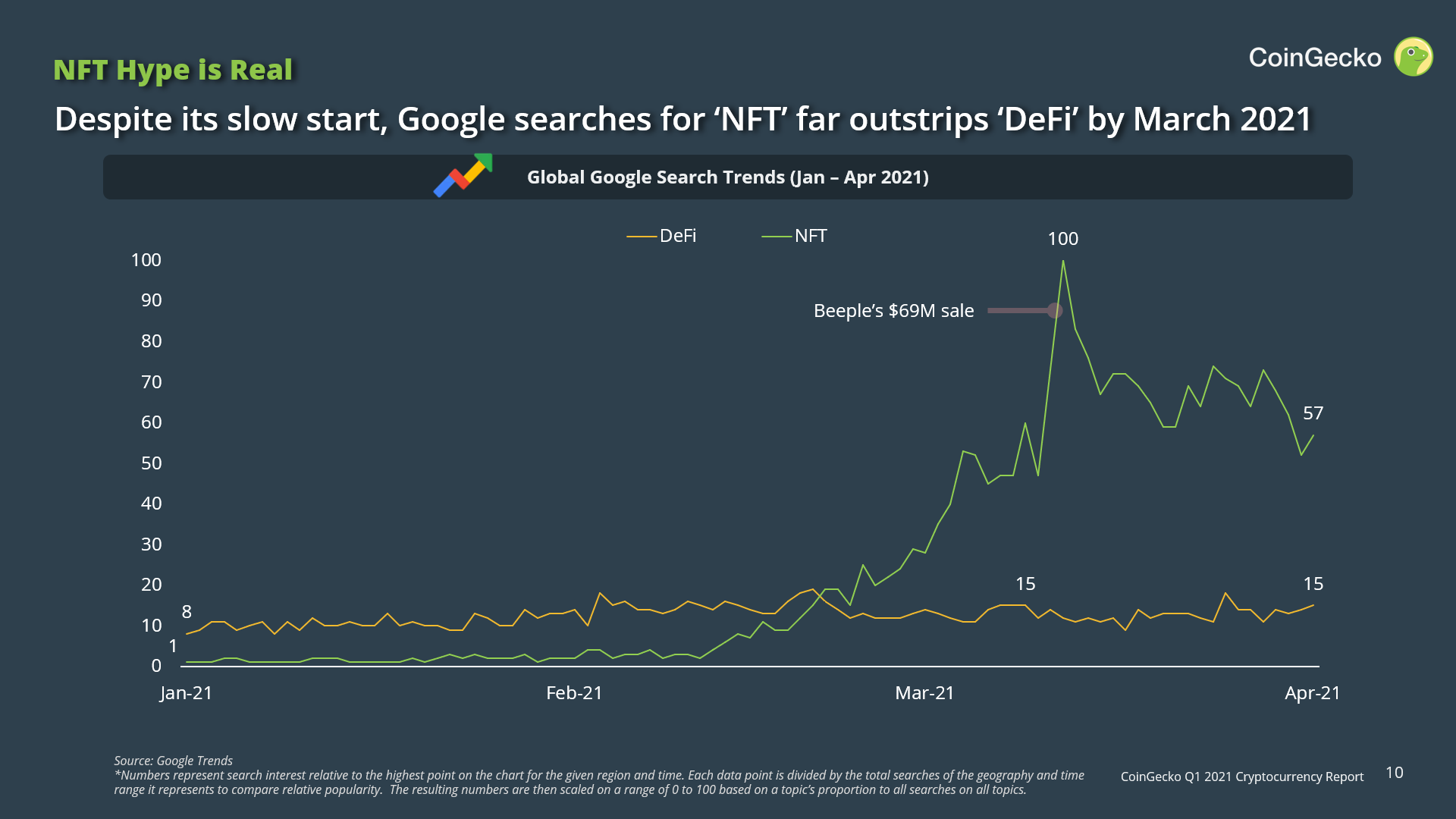

Google Trends show that NFTs flipped DeFi

At the beginning of the year, every Google search for NFTs also saw 8-times the number of searches for DeFi. However, NFT searches overtook DeFi by early March and then ended the quarter with a search ratio of 4:1.

Search interest for NFTs reached its ATH on the 12th of March which coincides with the day after Beeple successfully sold his art piece ‘Everydays: The First 5000 Days’ for $69 million dollars.

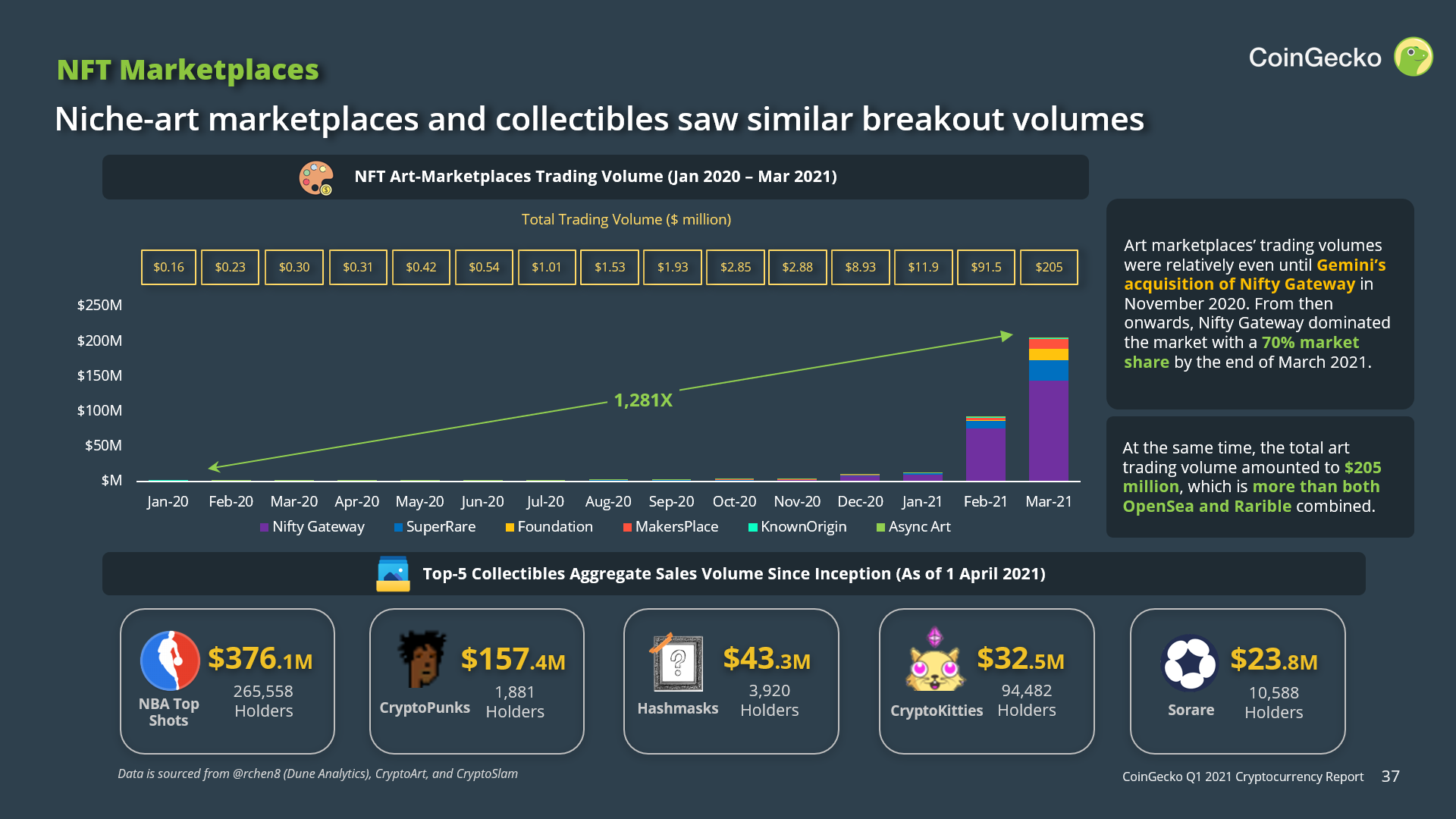

Total NFT art trading volume grew 1’281-times

Prior to Gemini’s acquisition of Nifty Gateway in November 2020, trading volumes of art marketplaces were relatively equal. By the end of March 2021, Nifty Gateway dominated the market with a 70% market share. At the same time, the total art trading volume amounted to $205 million, which is of greater value than both OpenSea and Rarible combined.

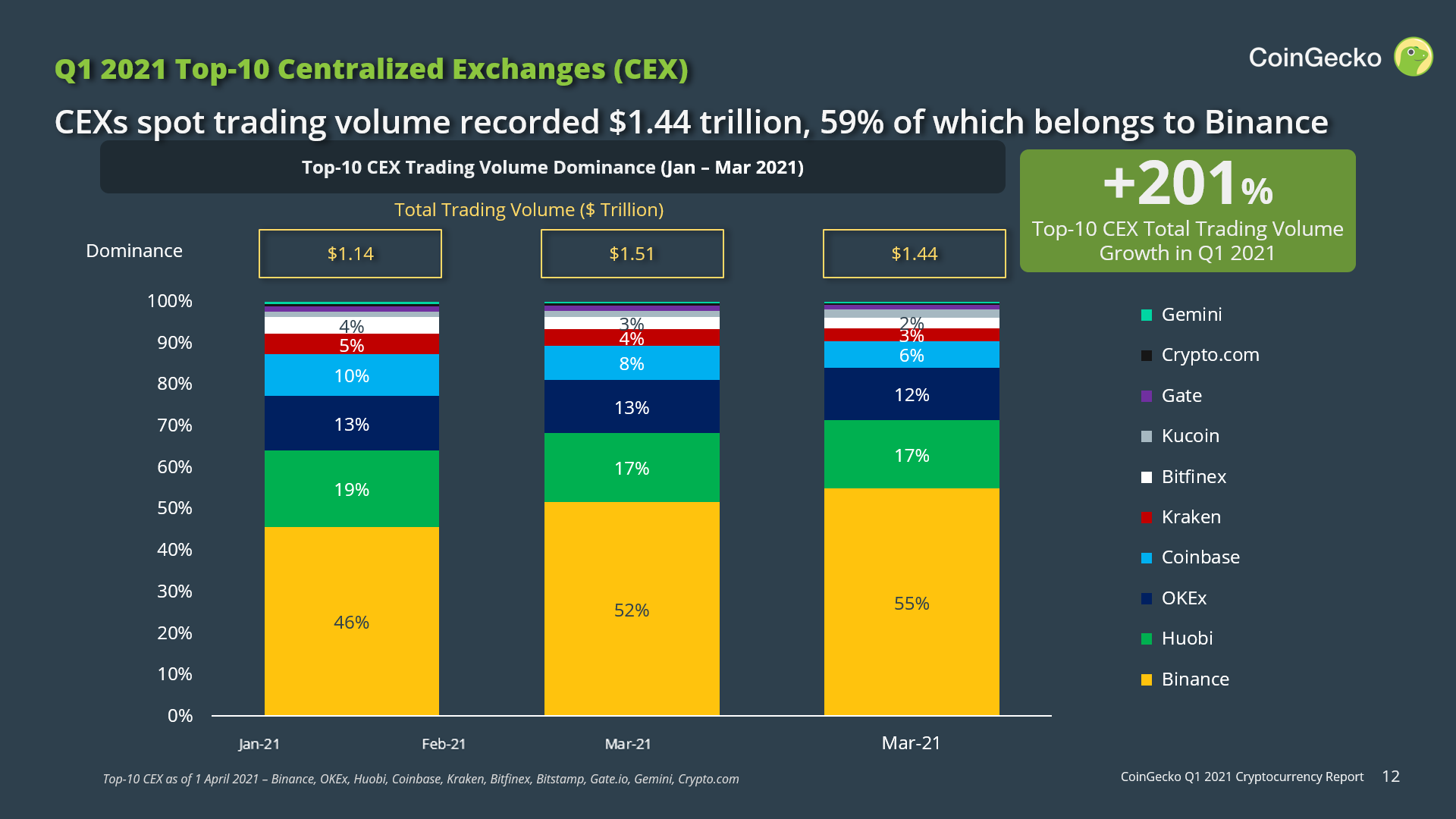

New record for CEX spot trading volume

Lastly, CEXs had a net increase of 201% in spot trading volume and ended the first quarter with $1.44 trillion. Binance is the major contributor to the increase and accounts for 59% (+571 billion) of the quarter’s increase. This is then followed by Huobi and OKEx at 15% and 11% respectively.

When taking a look at dominance, Binance and Kucoin are the only CEXs that saw an increase in market share. Binance then further cemented its dominance by rising from 46% to 55% of the total market share.

The post Trends Crypto Markets Q1 2021 appeared first on Crypto Valley Journal.