Our second report “Digital Asset Briefing” is out. Read all about the latest developments, trends and strategic impact on banking and payments from the world of cryptocurrencies, digital assets, tokens, CBDC’s and Decentralized Finance (DeFi).

Executive Summary:

- The recent unprecedent surge of Bitcoin and other major cryptocurrencies has led to renewed interest in digital assets. This, in turn, fuels the broader underlying trend of corporate & institutional adoption, as FOMO (“fear of missing out”) is kicking in across the trading floors and board rooms around the globe

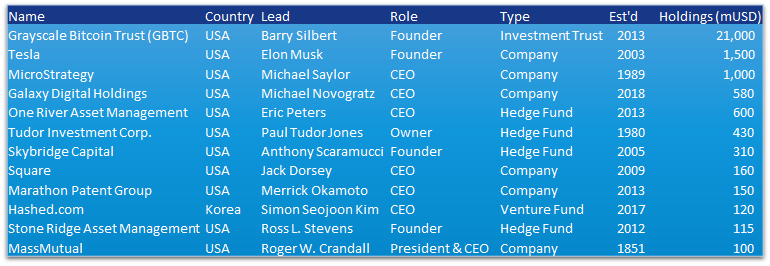

- Key drivers for recent price increases are favorable regulatory endorsements and clarity of rule sets, paired with several large institutional investments (incl. vocal statements of their CEOs) over the past few months. With Elon Musk’s 1.5bn USD invest, the “Whale List” keeps growing, accumulating 26bn USD of (known) institutional investments over just the past 6-8 months.

- The narrative for Bitcoin remains predominantly “digital gold”, considering growing global recession/ inflation expectations/ monetary policies. At the same time, lack of liquidity, high transaction fees and limited availability of institution-grade market infrastructure are still biggest hurdles to further scale-up of digital assets

- The fact that regulators around the globe have stepped up to face opportunities and challenges of digital assets conveys a promising outlook for further adoption. Still many questions remain open, as recent developments in the US demonstrate visibly

- Market volatility also confirms that cryptocurrencies still have no underlying “fair” value and price discovery is driven by liquidity, supply and demand. The past months have proven many self-declared crypto-economists wrong, who proposed methods to model a “fair value” of Bitcoin (e.g., based on underlying energy consumption and actual supply)

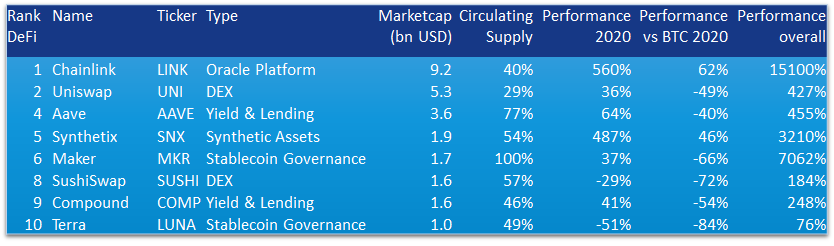

- Decentralized Finance, or DeFi, has also benefited significantly from Bitcoin’s surge over the past months. While this field of synthetic assets, staking & yield farming, and trading on decentralized exchanges can be seen as an arena for rapid prototyping, much innovation and creativity, the jury is still out on how regulators will respond to this growing sector within digital assets. Institutional commitments in this field have picked up recently, but the market is still driven by a large following of rent-seeking individual crypto investors

- Tokenization as a prime narrative within digital assets continues to progress slowly, but while the number of tokenization platforms and companies spirals upwards, actual large-scale success cases beyond government-led projects and bond tokenizations are still scarce

Author: Dr. Daniel Diemers, with kind support by Rami Maalouf and Ajit Tripathi (@chainyoda)

If you want to subscribe to the report, please send us an email to blockchain@snglr.digital