Good Morning!

Today, I would like to cover the role that airdrops play in price discovery, in light of two very interesting case studies:

- OmiseGo (OMG) and the BOBA airdrop took place on November 12, 2021

- Cream Finance (CREAM) and the veIB airdrop occurs on January 27, 2022 at 10am UTC

The term airdrop refers to “the distribution of digital assets to the public, either by virtue of holding a certain other token or simply by virtue of being an active wallet address on a particular blockchain.”

In practice, a user must, for the most part, hold a certain amount of a predefined asset in a public wallet at the time of the snapshot, and after that they will receive the new coins for “free” in their wallet.

The case of OMG

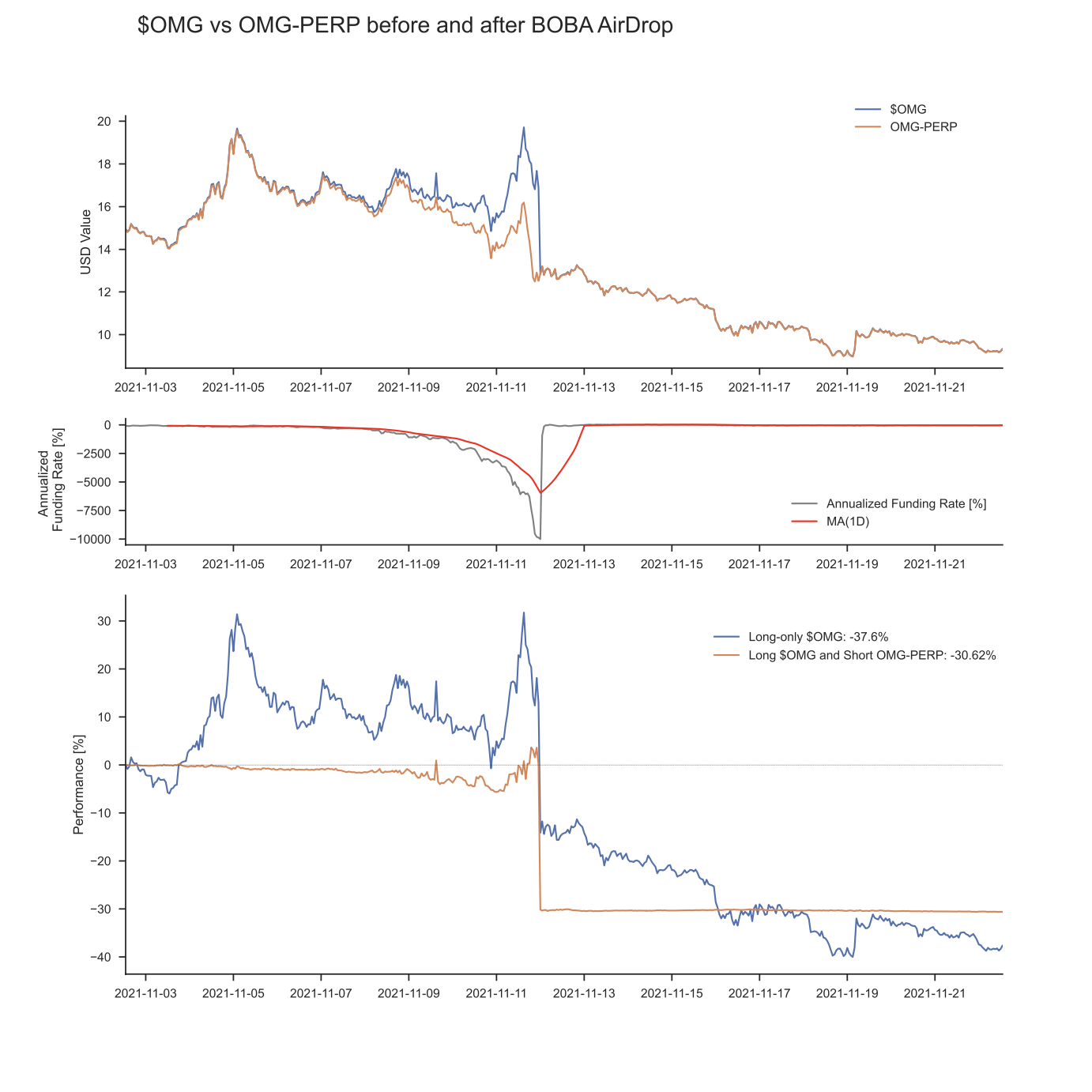

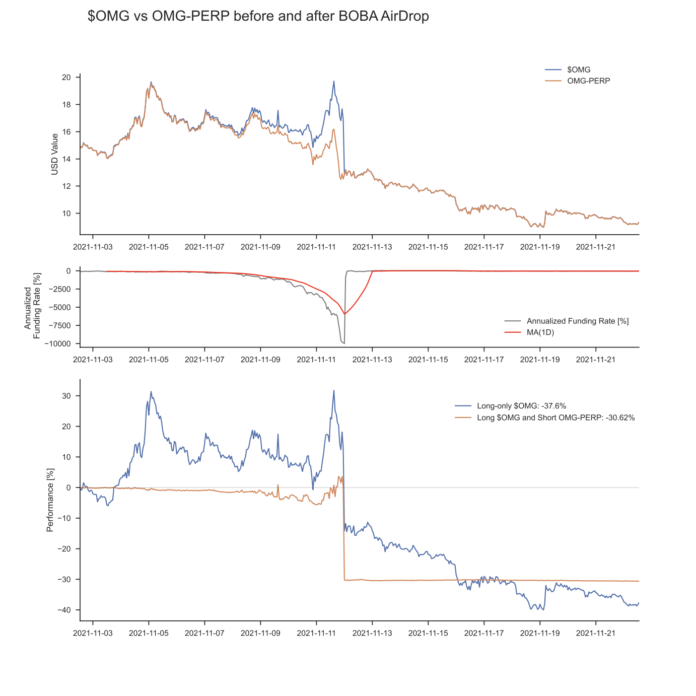

The BOBA Network announced that the OMG Foundation would launch a token to support the network (BOBA) with a governance token. Users holding OMG tokens on November 12, 2021 at 00:00 received a BOBA token for each OMG token they held in their wallets. This sounds great: free tokens! But, as you might surmise, behind every airdrop is a great deal of marketing hype trying to create project awareness to boost the price. In the first subplot on the below chart, you can see the price dynamics of OMG (blue line) and OMG-PERP (orange line) ten days before and after the airdrop (data provided by FTX.com).

Before the snapshot, the spot price increased from $15 to $20 (approx. 33%), while the future perpetual price went from $15 to around $16 (approx. 6%), creating a strong backwardation. After the snapshot, both prices plummeted and converged at around $13.5, and then continued to fall for the next few days that followed. The airdrop event created a strong demand and inflow into the spot market, but the Futures Market, which was not eligible for the airdrop, discounted the price more and more. Futures by nature always try to “anticipate” future events. The Trading team and I always like to remind ourselves that “there is always a reason when a future looks ‘cheap’ (backwardation) and when a future looks ‘expensive’ (contango)”. Well, this time things were pretty clear. In the second subplot, we can see the Hourly Funding Rates Annualised (grey line) and the one-day Moving Average of the funding rates (red line).

Potential strategies

Funding rates represent the “cost of capital” of entering a position in the perpetual futures market. When funding rates are greater than 0, the market is in contango. Also, when funding rates are positive, the holder of a long position will pay the funding rate every hour to the holder of a short position. Therefore, it is important to account for them when studying the PnL of a hedging strategy. Let us say we wanted the BOBA token, but we did not want to run the price risk. We would need to hedge our position by taking a short position in the futures market. Given the pronounced backwardation, every hour we would have to pay the funding, thus making this strategy really expensive.

In the third subplot, we see the performance of a long-only strategy on OMG (blue line), and the performance of a hedged strategy consisting of buying OMG and shorting OMG-PERP for the same notional amount (orange line). Both performed poorly: long-only: -37.6%, and the hedged one: -30.62%.

Finally, one should play the game in these three cases:

- One believes in a new project (BOBA, in this case) really strongly and wants to obtain the airdrop no matter the price of OMG.

- One is fast enough to get out before it is too late.

- One is a risk-lover and is trying to speculate by entering a leveraged long position in the perpetual, gaining the negative funding rates and any price increase.And today, almost the same thing is happening with CREAM.

The case of CREAM

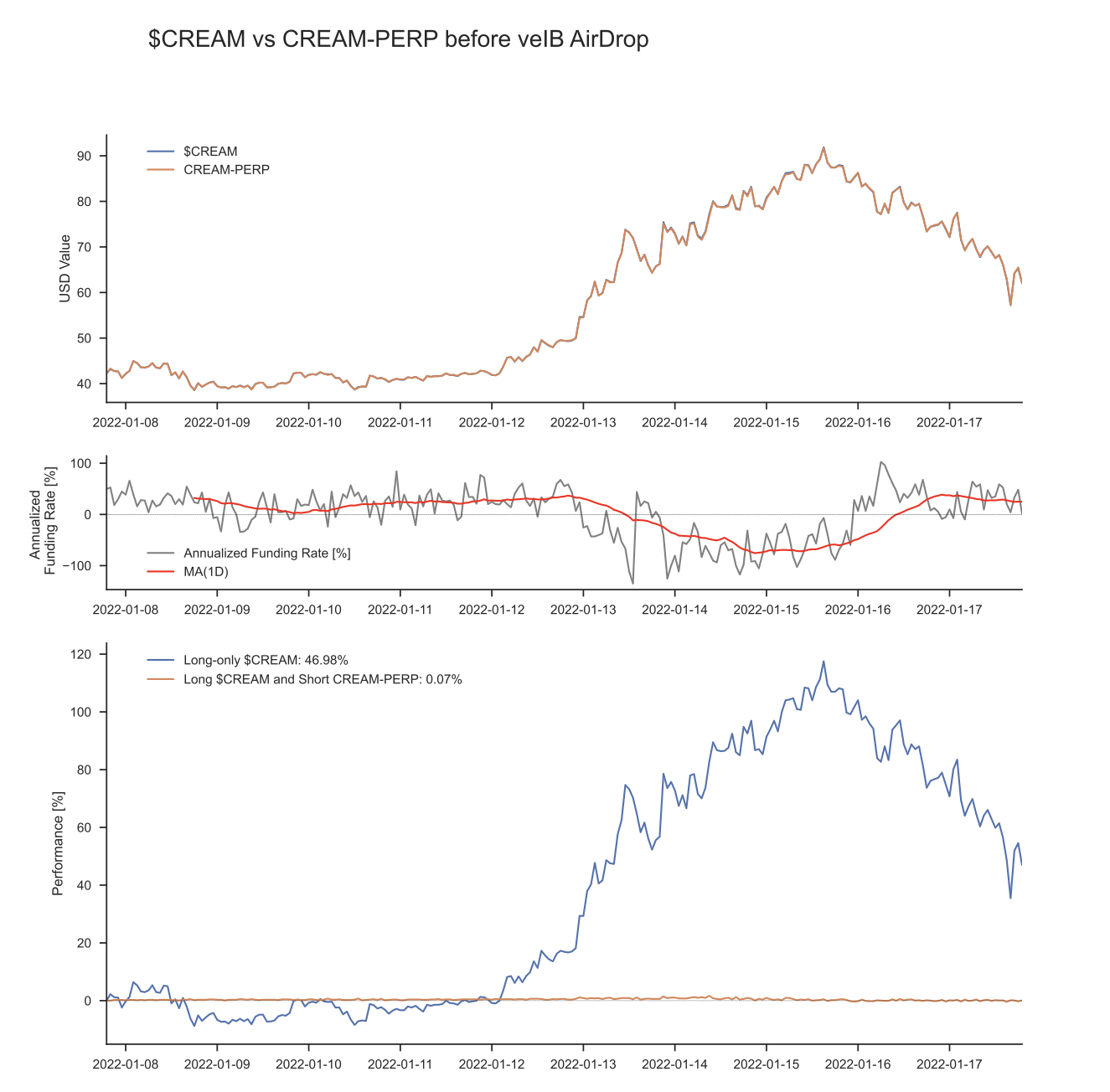

After the announcement of the new airdrop, the spot price started climbing: from $40 to roughly $90 (120% approx. in just two days), and the perpetual price followed slightly below this number. In my view, whether CREAM was really in high water, investors front ran the announcement too soon and too quickly. Assuming funding rates to be on average (optimistically) -100% annualised, shorting the perp and paying the funding for ten days will cost approx 2.8% too much. In the plot below, we can see the price dynamics (first subplot), the funding rates (second subplot), and the strategies performance (third subplot) as of today.

At the time of writing, CREAM is trading at $61. Looking at the charts and at some key indicators (RSI, MAs, etc.), I expect prices to drop a bit more before a nice rally occurs prior to the snapshot. Given the current market capitalisation of $38 million, a 100% price increase would not be out of the ordinary in the crypto space, but please do not forget to pay attention to the airdrop’s snapshot.

Happy trading!

All intellectual property, proprietary and other rights and interests in this publication and the subject matter hereof are owned by Crypto Broker AG including, without limitation, all registered design, copyright, trademark and service mark rights.

Disclaimer

This publication provided by Crypto Broker AG, a corporate entity registered under Swiss law, is published for information purposes only. This publication shall not constitute any investment advice respectively does not constitute an offer, solicitation or recommendation to acquire or dispose of any investment or to engage in any other transaction. This publication is not intended for solicitation purposes but only for use as general information. All descriptions, examples and calculations contained in this publication are for illustrative purposes only. While reasonable care has been taken in the preparation of this publication to provide details that are accurate and not misleading at the time of publication, Crypto Broker AG (a) does not make any representations or warranties regarding the information contained herein, whether express or implied, including without limitation any implied warranty of merchantability or fitness for a particular purpose or any warranty with respect to the accuracy, correctness, quality, completeness or timeliness of such information, and (b) shall not be responsible or liable for any third party’s use of any information contained herein under any circumstances, including, without limitation, in connection with actual trading or otherwise or for any errors or omissions contained in this publication.

Risk disclosure

Investments in virtual currencies are high-risk investments with the risk of total loss of the investment and you should not invest in virtual currencies unless you understand and can bear the risks involved with such investments. No information provided in this publication shall constitute investment advice. Crypto Broker AG excludes its liability for any losses arising from the use of, or reliance on, information provided in this publication.

The post Technical Analysis January 18, 2022 appeared first on Crypto Valley Journal.