The percentage of women in finance is low and far from proportional. Just as with traditional investments, this is also true for crypto investments. But why do women stay away from the financial world?

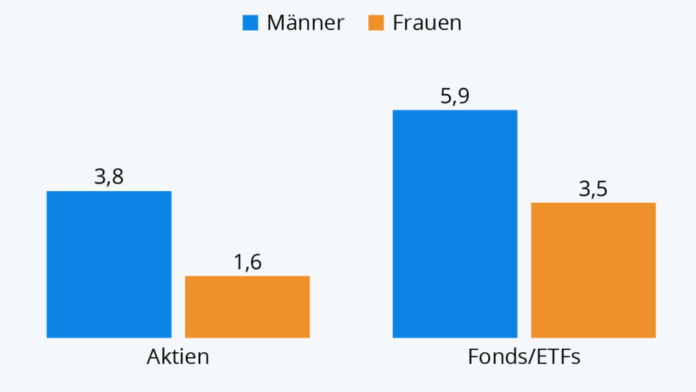

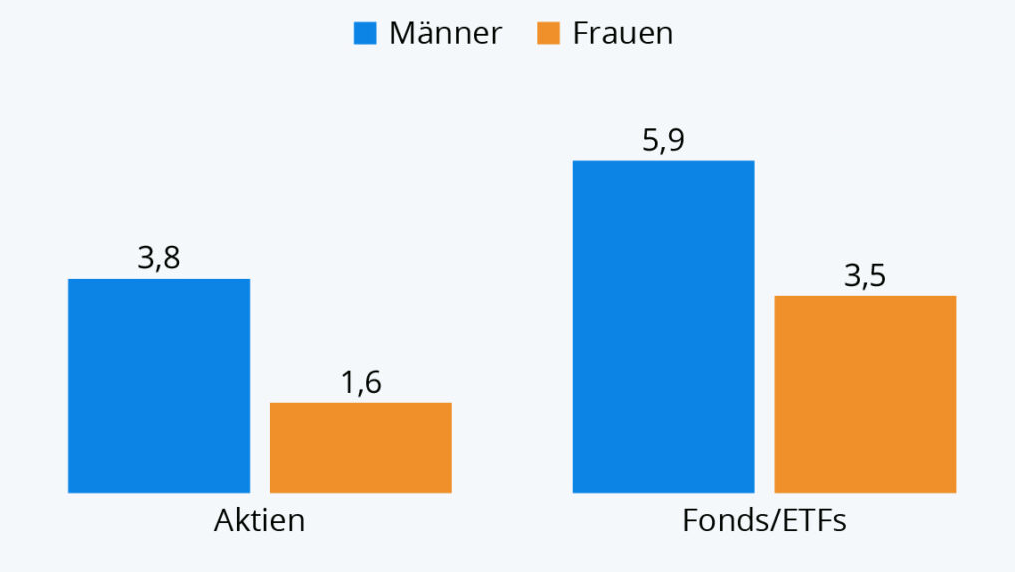

The percentage of women actively participating in the financial world is still low. This is because when it comes to stocks, ETFs or crypto investments, women are more hesitant than many men. Recent data from the German Equities Institute suggests that women’s participation in investing is significantly lower. According to the data, around 3.8 million German men and only 1.6 million German women invested in equities in 2020.

Different growth during Corona crisis

In the same year – during the Corona pandemic – around 64,000 women joined the proportion investing in ETFs and funds. On the male investor side, there was an increase of 1.1 million. The proportion of new female investors is therefore 5.7%, showing that comparatively there has been very little growth in female investors.

The distribution of savings behaviour between men and women is interesting. Almost nine out of ten people in Germany save, but this is completely independent of gender: 89.4% of German men save, 89.1% of women. It can be seen that the trend toward saving per se is without the gender divide. However, there are also clear differences in saving behaviour: Whereas only 18.4% of women can rely on investment experience when saving, 30% of men have already invested.

Investment behaviour in cryptocurrencies

Female investors also lag far behind when it comes to crypto investments. Only about 20% of investors are female, crypto trading platform Bitpanda reported earlier in 2020. In terms of crypto investing, younger investors tend to be more willing to take risks, whereas baby boomers, the oldest generation, are generally less willing to take risks. However, a gender gap can also be seen among Millenials. 27% of investing Millenial women, for example, describe themselves as “aggressive/active investors,” with a full 42% of Millenial men seeing themselves as such.

But there is also a positive trend to note: In 2020, the number of women investing in cryptocurrencies increased by 20%, reports a study by crypto exchange Gemini. The eToro platform also reports a sharp increase in the registration of women in 2020. Moreover, among those who plan to invest in cryptocurrencies, about 40% are women as well. The number of registration of female investors even increased by 366% compared to 2019.

The latter may sound like a good development at first, but one should take a closer look at the numbers. The share of women in crypto investments is still vanishingly small: after all, eToro’s figures also show that only 15% of all Bitcoin investors in 2021 are women. The share of Ethereum investors is 12%. In 2020, it was only 11% – an increase of just one percent. In Switzerland, even only 5% of women surveyed say they own Bitcoin, compared to 16% of men.

Are financial matters men’s issues?

Although many would deny this, a certain tendency can be seen in the direction of this prejudice. A study by UBS, a major Swiss bank, shows that only one in five women take care of their own long-term financial decisions. A full 60% of women in partnerships leave finances to their partners.

One problem with a certain interaction here is that men are also often ascribed the greater competence in matters of finances. Not infrequently because there is still an unequal distribution of earnings between men and women. Men are often the main earners. They have thus ascribed greater competence in the field.

However, various studies show that men are not necessarily more successful at investing. A study by the University of Berkeley came to the conclusion that men are more likely to lower their success by excessive trading than women, who tend to pursue a more conservative “buy and hold” strategy. While it is not possible to make a blanket statement about the differences in investment behaviour between men and women, there are studies that show certain trends.

Effects of underrepresentation

One reason for the underrepresentation of women in the financial sector could also be attributed to the complexity of the capital market and the many different types of information: The idea quickly arises that one cannot be successful without great mathematical or technical knowledge. In mathematical and scientific fields, men are statistically significantly more represented than women. In the UBS study, 68% of women stated that one must have a high level of knowledge in order to make good decisions in the financial market. Only 46% of all women stated that they had the necessary knowledge.

Interestingly, this is rather the opposite for men: As the University of Berkeley already pointed out in the aforementioned study, male investors often indulge in overestimating their own investment abilities. Again, no generalization is possible, but the study does describe some tendencies among male investors.

The low participation of women in the financial market, both in traditional investments, ETFs and stocks, as well as in cryptocurrencies makes and will make itself felt over time. Already today, 19% of women over the age of 65 feel acutely threatened by old-age poverty, which corresponds to about one in five women in Germany. By comparison, the situation is different for men: Only around 15% of those over 65 are at risk of acute old-age poverty.

Investments offer more opportunities for women

The relevance of cryptocurrencies around the world, and especially for women, should be highlighted. Poverty disproportionately impacts women – all over the world. This is supported by a variety of factors. For example, a lack of education regarding how to manage finances, as well as partnerships and family structures that prevent women from making their own financial decisions.

The effects and reasons for women’s underrepresentation in the crypto industry are thus closely intertwined. While women around the world struggle against their financial powerlessness, cryptocurrencies could be a big step toward financial freedom. The National Coalition Against Domestic Violence, for example, reports that 94% of female victims of domestic violence are also financially under the control of their partner. Decentralized Finance offers opportunities for women and other groups to break their financial dependence. After all, even in countries where people live in significantly greater affluence, it is a matter of existence for women to take care of their own finances.

The post Women less likely to be interested in crypto investing appeared first on Crypto Valley Journal.